SEO for financial services is no longer optional—it’s essential. In the US, the three most popular financial news websites, The Wall Street Journal, Investopedia, and Bloomberg, drive a staggering 48.5 million organic monthly traffic (as of January 2025). Investopedia alone ranks for over 4 million non-branded keywords related to banking, investment, personal finance, politics, etc.

The sheer volume of organic traffic, mainly from Google searches, demonstrates that users prefer reading extensively about finance. By reading, we mean not just website content but also user-generated content from community forums like Reddit, infographic images, Google Discover, short videos embedded in website landing pages, and social media pages.

In 2026, someone considering SEO for finance companies as the primary source of user acquisition channels should not limit themselves to the age-old idea of search engine optimization.

SEO should be defined as Search Everywhere Optimization. By everywhere, we mean every single media, including Google, meta platforms, community forums, review sites, and YouTube.

Now, SEO for financial services companies is a slow-moving and highly regulated process. Finance falls under the YMYL category, similar to health care. Finance content publishers, financial services providers, and consultants must follow the regulated process because people’s money is at stake.

Finance in all major developed and developing countries is highly regulated. Countries like the US, UK, and India have some of the strictest guidelines, and failing to follow them might bring unnecessary legal trouble.

SEO for financial firms which mainly deals with content, faces strict federal, state, and local regulations, along with Google’s financial product advertising restrictions, which complicate marketing efforts.

These regulations often slow processes as legal teams review content, leading to delays and backlogs. To address this, companies should:

Now, let’s dive into the important question.

Financial services cover a wide range of services, such as accounting, banking, finance, loans, credit cards, auditing, and more. Ideal customers can be companies, agencies, startups, enterprises, and even individuals.

Customers, whenever they need a service/information, go primarily to Google for three main reasons:

SEO for finance service providers ensures that a financial services website ranks on search engine result pages. The process aims to rank related queries, which are often categorized based on niche and service type. Financial services SEO agencies provides a scalable growth solution and collaborate with the in-house team to follow best practices across the finance website.

Because competition is fierce, and so many companies target similar keywords, it is important to have a clear SEO strategy that can compete with your competitors’ strengths and weaknesses.

Following the same approach as your competitor might not get you the same result.

Now, strategies may vary depending on the service/product type.

A strategy for enterprise accounting services will not be the same as that for enterprise accounting software.

However, the fundamental best practices that will be the core objects of this article will remain the same.

Complex finance content requires a unique angle, expertise, statistics, data, and future trends.

Without adding a unique angle, it is difficult to sustain in today’s search engines like Google, which introduces more AI features in their search results, resulting in lesser organic traffic to publishers.

High-quality content is more important than ever. Traditional AI tools may generate hundreds of pieces of content with a single click, but they are not unique. Anyone with money can buy a tool and develop content in bulk.

It is important to have a writer on a team with a background in finance, as finance deals with money and regulations.

Or, the content must be verified and reviewed by an expert. Also, a legal advisor’s involvement is required for complex topics, especially those involving government regulations.

It depends on the niche, though. For example, a credit card company must review complex content with the help of a banking expert and legal team.

On the other hand, An accountant based in London can review the service page content themselves without waiting for a legal team’s approval.

Before a financial service provider starts creating content, they must do the following analysis to make in-depth content:

On-page SEO best practices can help a financial content writer create content that is optimized for both the user and search engine.

The purpose of financial content, be it informative or commercial, is to get visibility from Google searches. Follow the fundamental best practices to ensure that your content stands out among hundreds of other web pages targeting the same niche.

Before one starts writing finance content, a detailed analysis of the search engine rank pages (SERPs) is necessary. SERPs can show a glimpse of what ranks well, what keywords your competitors have covered, the gap in the content, and a unique angle that can differentiate you from your competitors.

The most common mistake SEOs make while researching keywords is targeting high-search-volume keywords without giving much thought to their intent. High-search-volume keywords look fancy, but high traffic is not equal to high conversion. In fact, research shows that high-intent, low-volume keywords often convert better. Why? because those keywords are more specific.

Let us see an example:

If you search “business tax consultant“, any popular tool like ahrefs shows that the search volume from the USA is 300 searches/month.

The competition is fierce for this keyword, and it will take significant time and money to rank for it, especially if your consulting business is new.

So what should you do instead?

Target the keyword “tax consultant for small business,” which is significantly easier compared to the previous one; niche focus as it prioritizes the service for small businesses.

Please note: I am not saying we should not target high-volume keywords. We definitely should because that’s the long-term goal. However, for new financial service providers in the market, it makes sense to prioritize less competitive keywords. Please remember that optimizing your SEO budget is crucial. Spend it wisely on things that matter the most.

ON-page SEO builds the foundation of any website, landing page, or blog. A well-structured and logical ON-page supports your content.

Following are the best ON-Page best practices for financial service SEO:

The intent of the URL should be specific to the keyword you target on that page.

For example: “Tax consultants for small business“ page URL should be

abc.com/tax-consultant-for-small-business (The most common structure)

Or

abc.com/services/tax-consultant/small-businesses (with structured sub-folder)

Please note that both follow the best practices recommended by Google. But the second one is more specific if you provide more than one service under the same category.

For example, let’s assume you provide tax consulting for small businesses, working professionals, and enterprises.

You can create a logical URL structure for all three target audiences:

abc.com/services/tax-consultant/small-businesses

abc.com/services/tax-consultant/working-individuals

abc.com/services/tax-consultant/enterprises

For all the services, the core category “tax consultant“ remains the same. Only the industry changes based on your target audience.

Headers and sub-headers should contain either the target keyword or any modifier specific to your business. A good header not only helps in ranking but also helps in conversion.

The meta title still plays a crucial role in optimizing your page. The meta title, or SEO title, is the very first thing a user will see when they search for a keyword related to financial services. A well-optimized SEO title not only helps in SEO but also helps in getting a better click-through rate.

Gone are the days when placing random call-to-action buttons worked. Financial service providers or the agency providing finance services must understand that call-to-action buttons should be strategic and placed in a section that triggers interest among the user.

Image alt texts help Google crawlers understand the relevance of the image.

For example, if you are adding an image that shows a new credit card design, the image alt text should be “New credit card design for premium customers.”

Research all possible and relevant questions your target audience might ask about your financial services or products. There is no specific number of FAQs that you can add.

FAQs should be specific to the page or content’s intent. Try to blend some common queries, such as the cost of the product/service, customer support options, consultation/service period, and data privacy-related guidelines.

FAQ schemas are microdata that you can feed to search engines to help them better understand the intent of the content. Although Google officially mentioned that FAQs are no longer part of the ranking signal, it is advisable to add FAQ schemas in the format of structured data.

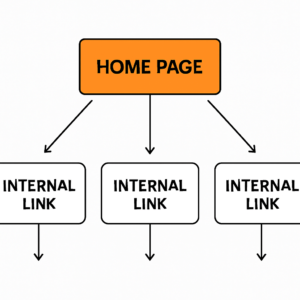

Internal linking is the most under-appreciated yet highly recommended ranking factor.

Internal linking provides an excellent navigational hierarchy between pages that helps both web crawlers and users.

For example, Let’s say you have a page that provides “Corporate accounting services in New York.”

This page is purely commercial and intends to drive inbound sales leads.

Let’s say you have invested in another page that provides information on “How to open a company account in New York in 5 easy steps”.

The 2nd example is purely informative, and pushing sales intent might not be a good idea.

But a good financial SEO strategist will find a place in that informative content and add a relevant sentence that says, “managing company accounts for private limited companies is a must that every business owner should follow. A well-managed company account can help businesses get loans or funding to further enhance their business growth. Now, corporate accounting is a tedious process that requires expertise. Always consult with a corporate accountant before submitting your yearly financials.”

Now, see the anchor text in bold. This looks like a relevant anchor text.

The example showed a link between the informative and commercial pages. A user who opens a company account can find a solution on the informative page.

Maintaining a logical internal linking structure is crucial. Each page should follow a logical hierarchy and help users navigate.

Local businesses like accounting firms, mortgage brokers, banks, and finance consultants should prioritize their physical establishment.

Any business that provides a service in a particular area, such as an accountant providing consulting services in New York, should optimize its local presence.

Local SEO for financial services brings genuine leads from location-specific searches.

Optimizing pages for a location or multiple locations makes sense as people will always search by location for local intent services.

For a small business in New York, it makes sense to hire an accountant from New York rather than from Florida.

Here are essential factors to consider:

By addressing these fundamental factors, you’ll effectively promote your business to clients precisely when they’re looking for your financial expertise.

Building topical authority for middle-of-the-funnel keywords in financial SEO is like becoming the go-to person people think of when they have questions about specific finance topics.

Imagine someone who’s done some initial research and is now looking into details—maybe they want to know more about retirement planning or picking a tax advisor. At this stage, they’re looking for clear, helpful answers.

You must provide easy-to-read articles or blogs that address these exact questions. Let’s say you’re an accountant in New York; you might write posts like “Simple Ways to Save Money on Your Taxes in New York“ or “What to Look for in a Retirement Account.“ These topics directly answer the questions your potential clients are thinking about.

Once you’ve created these pieces, connecting related topics is essential. When writing about retirement planning, you might include investment options or pension management content. Linking these articles together helps readers easily navigate your content and shows search engines that you’re an expert on these related topics.

Also, keep your content fresh and updated. Regular updates tell readers and search engines you provide helpful, current information. Over time, this builds trust, improves visibility, and makes financial services more appealing to potential clients.

Every business owner, marketing and SEO manager, or SEO specialist should remember that authority does not equal domain authority, which people typically measure as their KPIs.

Real authority is built when you get backlinks from finance-specific domains. Finance links are costlier and harder to get.

You might find hundreds of PBNs claiming that they cover finance content, but to judge the absolute authority, follow the below-given parameters:

You need clear, simple indicators to understand if your strategies are working. Let’s look at a few essential KPIs (Key Performance Indicators) you should monitor.

First is organic traffic, which refers to how many visitors visit your website directly from search engines like Google. For example, if you’re an accountant in New York, you’ll want to see how many people find your website when searching for “New York accountant“ or related terms.

Next, Keyword Rankings tell you how high your website appears in search results for your targeted keywords. If your site moves from page 2 to page 1 for “Tax Advisor NYC,” you’re doing something right!

Then there’s the Conversion Rate—the percentage of visitors who take a desired action, like filling out a consultation form or calling your office. If 100 people visit your tax planning page and five contact you, that’s a 5% conversion rate.

Another important KPI is Bounce Rate, or how many people leave your site quickly without interacting. A lower bounce rate usually means visitors find your content helpful.

Finally, monitor your Local Pack Visibility. This is your presence in the map listings when someone searches locally, like “financial planner near me.“ Appearing here increases your chances of attracting clients right from your neighborhood.

Keeping track of these KPIs gives you a clear, straightforward picture of your SEO performance, helping you continually refine your strategies for better results.

People research loans, cards, and investments online before they talk to anyone. If you don’t show up, a rival will. Good SEO brings the right visitors and steady leads.

Start with product terms plus intent, like “home loan rates,” “best fixed deposit,” “business credit card perks,” and “financial advisor near me.” Add local city names if you serve a region.

Show real experts with names, photos, and credentials. Add clear disclaimers, dates, and sources. Keep facts consistent across your site, profiles, and listings.

Strong product pages, fees and rates pages, comparison pages, FAQs, calculators, and a simple “how it works” page. Add About, Team, Reviews, and Contact with phone and address.

Use plain language. Answer real questions fast with examples and numbers. Avoid promises you can’t keep and invite users to talk if they need personal advice.

Yes, if each post solves a real problem. Topics like “how to pick a home loan,” “credit score tips,” or “tax saving options” work well. Keep it updated.

Make them fast, easy, and accurate. Add clear steps, example results, and short FAQs below the tool. Link them from your product pages.

Links from news sites, local chambers, universities, trusted blogs, and partners. Avoid paid link farms. Earn links with data studies, tools, and guides.

Publish a small report on rates or costs, launch a useful calculator, or create a city guide for first-time buyers. Pitch it to local media and niche blogs.

New pages can move in weeks. Competitive finance terms often take 3–6 months. Keep shipping good pages, improving speed, and earning real links.

Leads, calls, and form submits. Organic clicks and rankings for top terms. Page speed, bounce rate, and how users move from info pages to product pages.

Make a page for each branch with NAP details, maps, hours, and nearby landmarks. Keep Google Business Profiles updated with photos, products, and posts.

Stick to facts. Say what the product does, the risks, and fees. Add a simple disclaimer and review content with your compliance team.

Use AI to draft ideas, not final advice. Have a real expert review, fix, and sign off. Add their name and date.

Fast mobile load, clean URLs, secure site, simple menus, and no broken links. Use structured data so search engines can read rates, reviews, and FAQs.

Fresh, real reviews boost trust and clicks. Ask happy clients to leave feedback on Google and your site. Reply to all reviews with care.

Pick a niche or region and go deep. Offer clearer pages, faster tools, and better guidance. Be the most helpful result for that user’s exact question.

Yes. Compare your plans with common choices users consider. Be fair and show who each option fits best. Users value honesty.

Short sentences. Simple words. Clear headings. Bullets where it helps. Add examples and a quick summary at the top.